north dakota sales tax registration

No Fee in NC to Apply for a Certificate of Registration Register Online Register by Mail Other Information Information. Ad Sales Tax Nd Same Day.

North Dakota Sales Tax Information Sales Tax Rates And Deadlines

North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders.

. Or file by mail using the North Dakota Application for Income Tax Withholding and Sales and Use Tax Permit. Registered users will be able to file and. Send the completed form to.

ND TAP uses industry standard security features like multi-factor. The sales tax on a car purchased in North Dakota is 5. Thursday June 23 2022 - 0900 am Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up.

North Dakota State Sales Tax Online Registration North Dakota State Sales Tax Online Registration Any business that sells goods or taxable services within the state of North. Sales Tax Nd- Current Update Feb 2022. Sales Tax Nd- Current Update Feb 2022.

Sales and Use Tax Registration Registration Who Should Register and File. If You Have Employees - Income Tax Withholding Guidelines and Registration If You Have Employees. In addition to the North Dakota sales tax rate there may be one or more local sales taxes and one.

The average local tax rate in North Dakota is. North Dakota Sales Tax Application Registration North Dakota Sales Tax Application Registration Any business that sells goods or taxable services within the state of North Dakota to. Office of State Tax Commissioner.

Form 306 - Income Tax Withholding Return. However this does not include any potential local or county taxes. The Secretary of States staff cannot provide legal advice regarding advantages of the various business structures filings transactions taxes financing indemnification shares stock.

This free and secure site allows taxpayers to manage their North Dakota tax accounts from any device at any time. Manage your North Dakota business tax accounts with Taxpayer Access point TAP. North Dakota enacted a general state sales tax in 1935 and the rate has since climbed to 5.

TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view. If you currently have or plan to have employees performing services within North. Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of.

NORTH DAKOTA SALES TAX 5 County Tax - Yes Personal Property Tax No 701 328-7088 or 877 328-7088 REGISTRATIONS Documented Boats are Not Required to Be Registered. North Dakota New Business Registration Welcome To The New Business Registration Web Site Thank you for selecting the State of North Dakota as the home for your new business. NORTH DAKOTA SALES TAX 5 County Tax - Yes Personal Property Tax No 701 328-7088 or 877 328-7088 REGISTRATIONS Documented Boats are Not Required to Be Registered.

Ad Sales Tax Nd Same Day.

North Dakota Charitable Registration Harbor Compliance

South Dakota Sales Tax Small Business Guide Truic

Sales Tax Guide For Online Courses

How To Register For A Sales Tax Permit Taxjar

Register For Sales Use Tax Permits In Every State Harbor Compliance

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

Sales Use Tax South Dakota Department Of Revenue

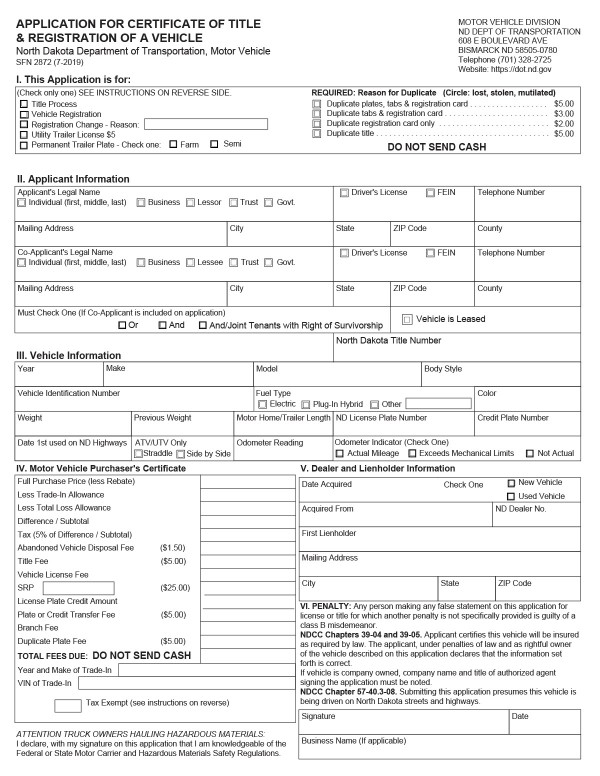

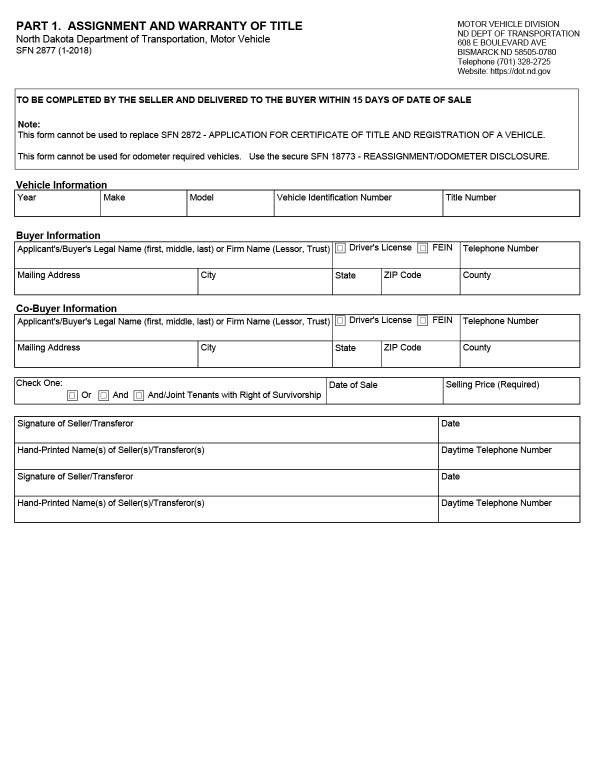

About Bills Of Sale In North Dakota What You Need To Know

About Bills Of Sale In North Dakota What You Need To Know

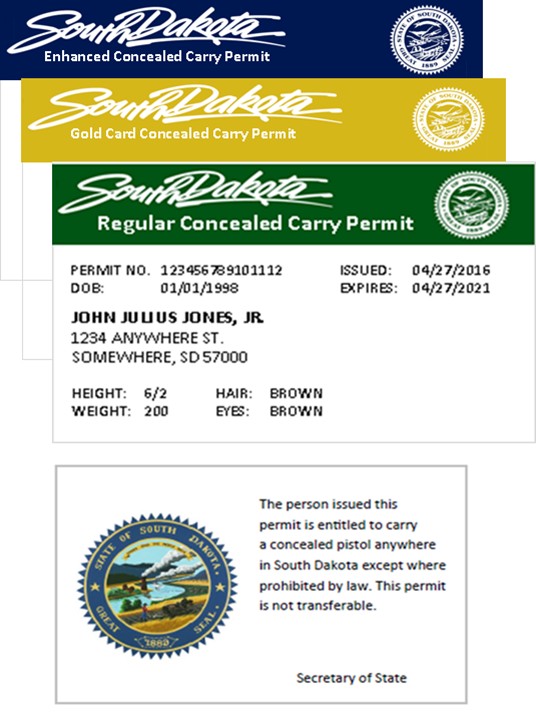

Concealed Pistol Permits South Dakota Secretary Of State